Bowie Bank

The first celebrity-branded white-label digital bank

Overview

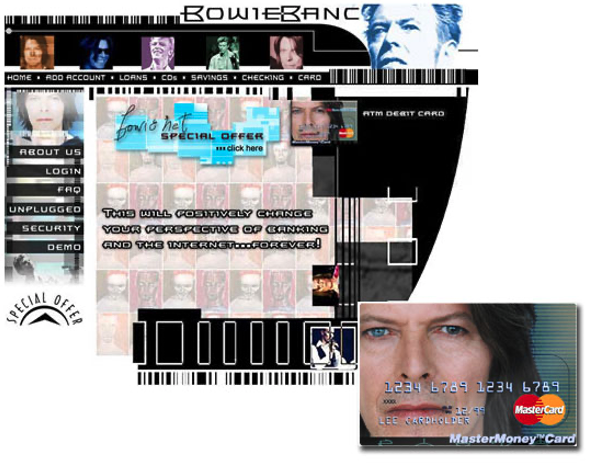

Bowie Bank was a groundbreaking partnership between our white-label banking platform and music legend David Bowie. Built in the early 2000s, it offered fans and users access to fully functional online banking under Bowie’s name and aesthetic — long before “embedded finance” became a mainstream concept.

Impact

Bowie Bank wasn’t just a novelty — it helped pioneer the idea that banking could be personalized, cultural, and creative. It also paved the way for me to launch other private label banks on the same platform, including branded banks for the New York Yankees, Baltimore Orioles, and the first online Spanish-language bank.

Bowie Bank proved that trusted cultural figures could help introduce new communities to banking in ways that felt approachable, modern, and aspirational. It remains one of the earliest — and boldest — experiments in brand-integrated finance.

Solution

We built a multi-tenant banking system that could power fully branded, legally compliant online banks — starting with Bowie Bank. Using our own charter and core technology, we offered checking, savings, CDs, and debit services through a fully skinned Bowie-branded experience. We handled the tech, compliance, and operations — Bowie brought the vision.

Challenge

At the time, digital banking was still in its infancy. Most consumers didn’t trust online banks, and traditional financial institutions weren’t built to speak to niche or culturally-specific audiences. There was no infrastructure that could provide secure banking and reflect a brand’s unique personality.